Working with the best

Our solutions are tried and tested, strong and scalable, helping you to reduce risks and improve security and stability.

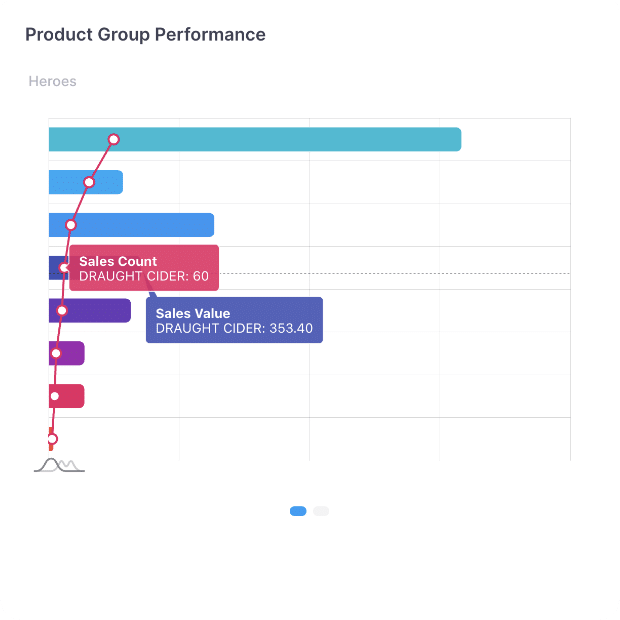

Make more informed, data-driven business decisions with our fully customisable reporting and analytics dashboards.

Our easy-to-use software and hardware options have been designed to reduce downtime in your business, with features including offline payments should your network go down.

clients around the world

of industry experience

transactions processed

support all year-round

operating systems supported

revenues processed

payment provider integrations

terminals installed & operational

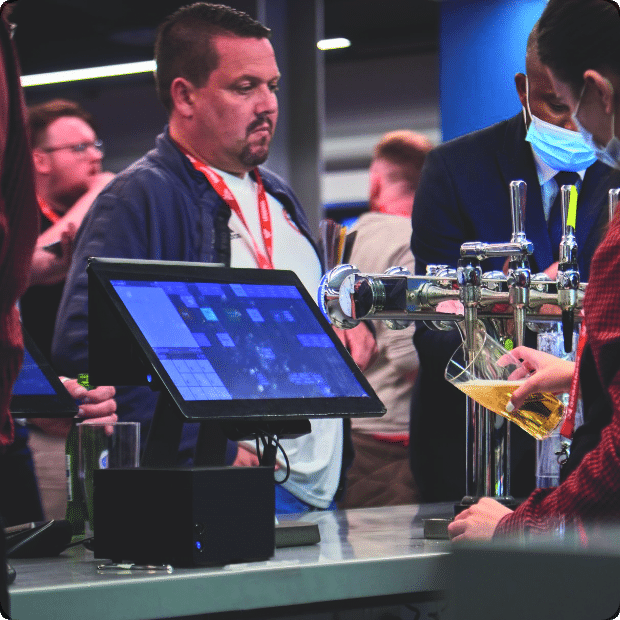

Cut your carbon footprint, reduce energy costs and minimise IT overhead with the Kappture embedded point-of-sale terminals.

Providing quicker and easier transactions, our terminal hardware includes our innovative K2 & K2C, which can be installed and configured in a variety of ways to fit your hospitality or retail environment.

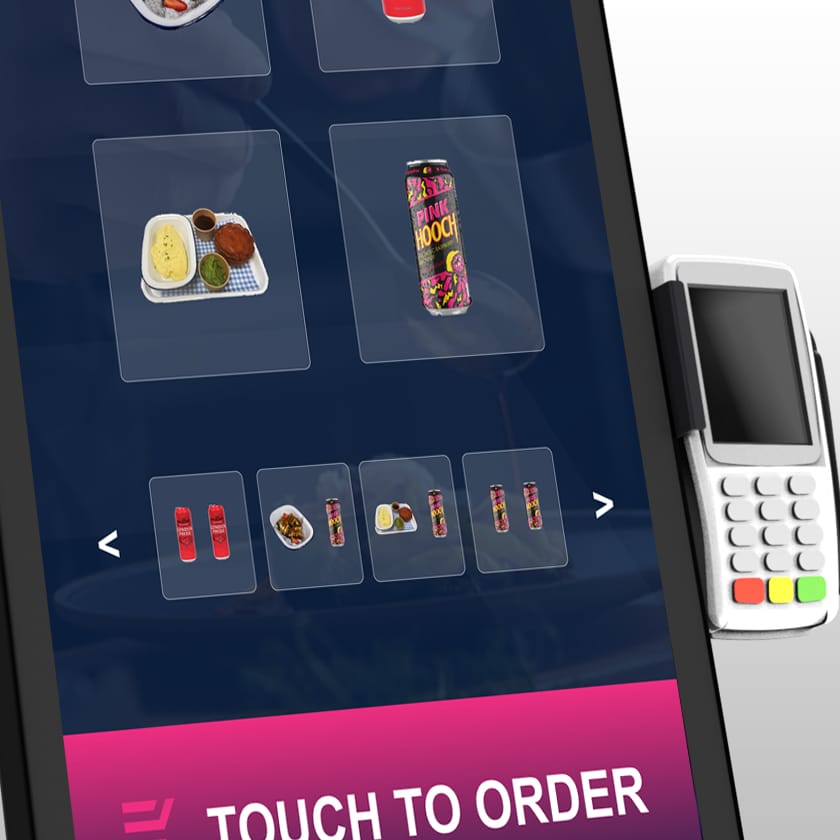

Designed to reduce queue times in your establishment and maximise your revenue, our kiosk hardware offers an intuitive user experience.

Branded to your specifications, they can match the interior of your business, helping to reinforce your brand identity.

Our easy-to-use solution can also integrate with the payment service provider of your choice.

Kappture’s mobile EPoS hardware options include Castle Technology & the PAXA920 Standard and Pro Models.

Our cost-effective mobile EPoS solutions are ideal for taking payments quickly and efficiently. They offer high security and are easy to set up too.

Our Kitchen Management System (KMS) can be configured to match your kitchen operations, enhance throughput and streamline efficiency.

By providing a seamless and integrated approach, this solution provides the flexibility and functionality required to meet the requirements of all kitchen set ups.